For anyone that owns a smartphone there are several personal finance apps you can get. Knowing which one to choose depends on the priorities of the consumer.

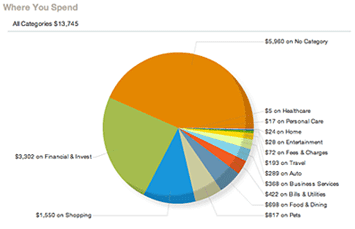

A popular and free app to get is Mint which is available for the iphone or the android. The main purpose for Mint is to track your own personal finances. Not only is Mint free but there is no local software to install which makes it easy to use on your smart device or web browser. Each time you visit your Mint app your financial information is updated automatically. What is especially convenient about Mint is that it comes with easy to view graphs of your purchasing history. A regular feature is being able to keep track of every transaction a person makes and categorizes the purchase so that at the end of a spending period a person can easily review where their money has gone.

Mint is also involved in several areas of finance, areas such as banking, credit cards, loans, and even investing accounts.

Another app that is popular is Dave Ramsey's BUDGT. This app is not as nuanced as Mint, but it is a fast and lightweight program. Easily create and manage a monthly budget with BUDGT. According to one user the genius of BUDGT is its simplicity, "Clean screens, bold fonts, and pie charts make it easy to input and track your expenses." BUDGT is 99 cents for the iphone.

Jumsoft is slightly different when it comes to the personal finance app world. This is for those that like to run their own finances by creating their own categories to keep track of. For example if a person wanted to track specifically one bill within a category, like an electric bill within home finances, an electric bill category could be created and tracked periodically. Jumsoft also works with multiple currencies and develops easy to use info-graphics.