There are several ways to budget your finances but what is most important is the way we follow through with our budgeting. Planning to practice the perfect budget may be out of reach for most people so here are a few tips to keep us in line with our budget even though we might want to spend our money on our favorite purchases.

1) Create a bank account you don't have online access to.

The idea behind this is that you have your main bank account and then you have your true savings bank account. What you do is set up a monthly transfer between your main account and your savings account, both of which must be at different bank accounts. Then you must restrict yourself from withdrawing from you savings account by not giving yourself online access to it and not carrying around a debt card from that account. This way you will physically have to go to the bank to acquire the money that you have saved. Hopefully this will help incentivize you to not spend money that you need to save!

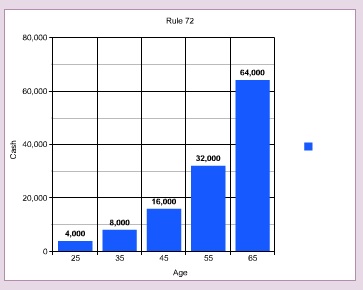

2) Concentrate on the rule of 72

The point of the rule of 72 is to know about how long it takes for your money to double. The calculation goes like this: divide 72 by the rate at which you are getting a return, for easy math lets pretend we are getting a rate of 7.2% (which is actually pretty high!). This means that it will take 10 years for the money we are saving to double and if we calculate $4,000 saved over a 40 year period that money increases from 4,000 to 8,000, to 16,000, to 32,000 to finally $64,000. Now imagine if more money had been saved every year over that time period, just think of how much savings a person could have! There is a reason why Einstein said "the power of compound interest is the most powerful force in the universe."

Hopefully these few tips will help anyone with facilitating their own personal savings and with planning for a better future.